There are many fund managers, stock brokers, and financial advisors who provide guidance on buying mutual funds and other investment assets. However, very few discuss aspects of selling, or rather, very few know when to sell investment assets and cash in the profit or limit the loss.

Mutual funds are operated by a fund manager from an Asset Management Company (AMC). A mutual fund invests in a portfolio of stocks based on its objective and strategy. The objective can be to provide income, growth, or both. The fund follows an overarching theme that guides the investment. The theme can be based on market cap, sector, growth and value stocks, new-age stocks, etc.

Investors buy and sell mutual funds because they provide a better risk control mechanism than investing in stocks. Mutual funds also provide diversification at an economical price, which would have been impossible to replicate by investing in individual stocks. Let’s discuss when investors should sell mutual funds.

A change in the fund manager:

A fund manager plays the most crucial role in the performance of mutual funds. If a mutual fund is doing very well under a fund manager, a change of fund manager may disrupt the performance. The fund manager may change for various reasons, like leaving the AMC, opting for other funds within the same AMC, etc. In such cases, observe the returns for a few quarters, and if they deteriorate, investors can think of selling the fund.

Changes in fund managers may not always impact performance. For example, index funds that track a benchmark index will do what the underlying index does, regardless of the fund manager.

Change in strategy & objective of the fund:

Investors select mutual funds for investment based on the fund’s objective and financial goals. Suppose a person needs income from the investment. In that case, they may like to invest in funds whose objective is to provide regular income by investing in dividend-paying stocks and assets that offer monthly returns. If the fund manager suddenly starts investing in growth stocks and bets on price appreciation, the fund must help the investor achieve the intended financial goal. This could be the time to liquidate the mutual fund.

Similarly, if the mutual fund changes the way it allocates funds to different assets, this may be a sign to reevaluate your investment. If the change doesn’t serve investors’ financial goals, they should exit it. For example, if a fund adopts a balanced strategy where it invests 50% in debt and 50% in equity and suddenly changes the mix to 40% in debt and 60% in equity, this may expose investors to higher risks.

Underperformance for a long time:

Typically, equity-oriented aggressive funds and balanced funds are long-term investment assets, and hence, investors should give their investments some time to achieve returns. However, if the fund underperforms year after year, it may indicate that the investors should opt-out.

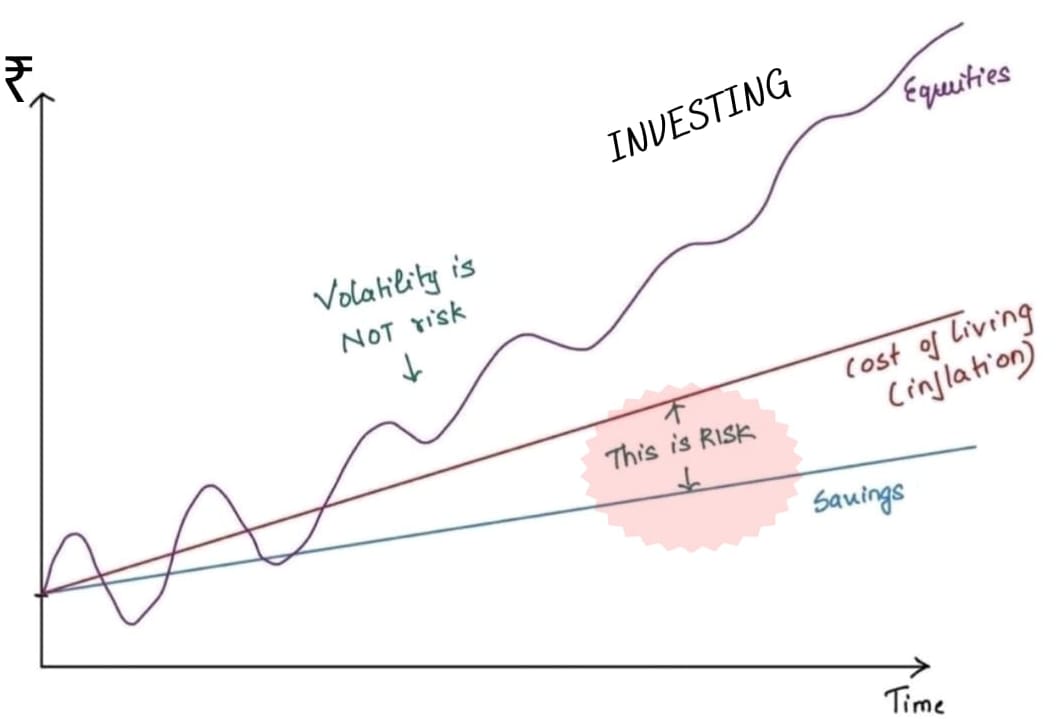

Investors should, however, not look at short-term performance and consider temporary fluctuations in returns as fundamental flaws in the fund. Any mutual fund, irrespective of the businesses behind it, can face temporary fluctuations. Investors should observe fund performance for a few years and decide accordingly. To judge the fund’s return, Investors may compare the returns with similar funds or a benchmark index.

For example, if investors have invested in Franklin FMCG Fund (Growth) and wish to evaluate its performance, they should see the absolute performance for the last 3-5-10 years. They can also compare returns with funds like ICICI Prudential FMCG Fund (Growth), which has similar attributes. Investors can also compare returns with Index funds such as Birla Sun Life Nifty ETF.

Conclusion:

Mutual funds are the best way to invest in a portfolio of sound companies without investing in individual companies. Investors should not sell their mutual funds because of short-term volatility. Study the alternatives, fundamental changes in the fund, and the pros and cons before deciding to sell.

![]() Rahul Agrwal

Rahul Agrwal

Founder: Singhal Capital FinServe & Your Money Mantra

Pretty! This was a really wonderful post. Thank you for your provided information.