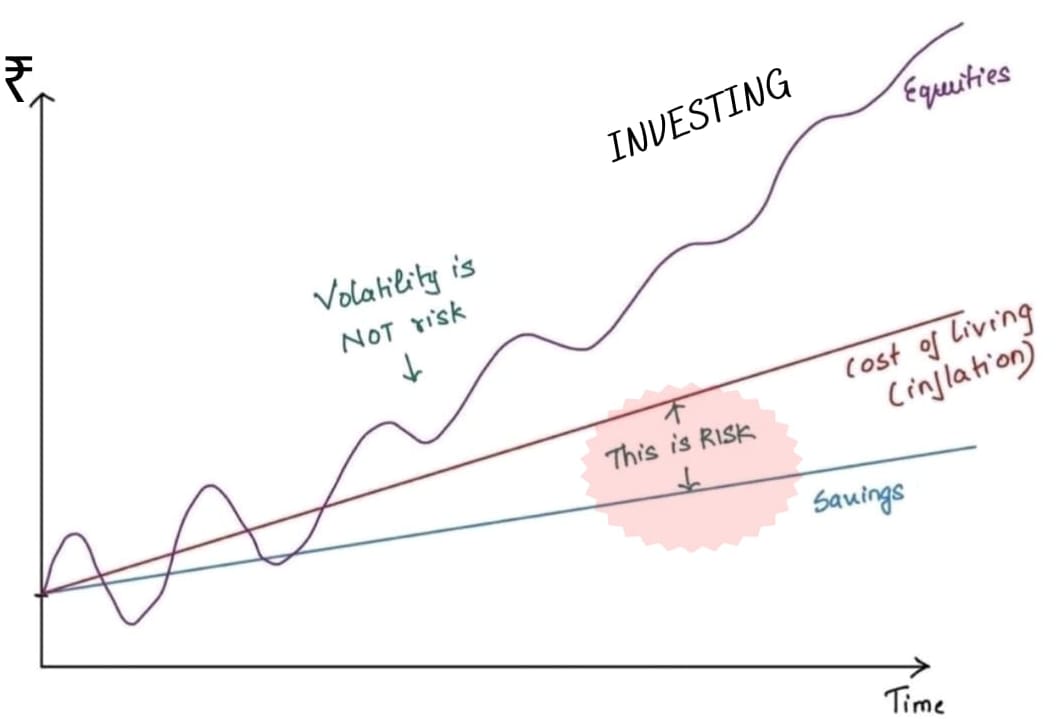

As we are Indian, at every closing of the old year, we check how many holidays are coming in the new year. Most holidays are spent somewhere on tourist trips, and days are days when our holidays only involve going to the granny and nanny’s home or parental house. Now, it is time to think differently so that the tourism industry is not a “once in a blue moon” like industry.

So, keeping this in mind, Kotak Mutual Fund has seen a lot of potential in the tourism industry and has landed a new shining star in its bouquet.

Kotak MF has launched a New Fund Offer (NFO), Kotak Nifty India Tourism Index Fund. This fund is a passive fund category fund that will track the Nifty India Tourism Index. India is a land of great geographical diversity (mountains, oceans, deserts, jungles, etc.), as well as historical heritage, cultural diversity, and religious centres.

Tourism and Hospitality are two of India’s largest service industries and can play an important role in the country’s economic growth. The Government recognizes the enormous potential of tourism in India and has firmly placed tourism as a key sector in Union Budget 2024, with allocations of Rs 2,400 crores towards this sector. The Nifty India Tourism Index can provide attractive thematic investment opportunities for investors.

Prior to the launch of the Kotak Nifty India Tourism Index Fund, there was only one tourism thematic fund, which was also launched recently. The Kotak Nifty India Tourism Index Fund NFO opened for subscription on 2nd September 2024 and will close on 16th September 2024. In this article, we will review the NFO Kotak Nifty India Tourism Index Fund.

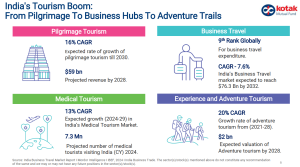

From Pilgrimage To Business Hub To Adventure Trip:

- Pilgrimage tourism: 16% CAGR expected growth of pilgrimage tourism till 2030 and $59 billion revenue expected.

- Business Hub: 7.6% CAGR growth expected by India Business Travel and $76.3 billion revenue expected by 2032.

- Medical Tourism: 13% CAGR growth expected by 2029 and 7.3 Million projected number of medical tourists visiting India by 2024

- Adventure Tourism: 20% CAGR growth is expected by 2028, and a valuation of $2 billion is expected by 2028.

Source: Kotak MF

Tourism is booming in India.

With rising per capita income and a growing middle class, India’s tourism industry is thriving. Here are some key highlights:-

- India is the 3rd largest Aviation in the world. We have 153 operational airports in the country and an annual passenger traffic of 181 million, which is expected to triple by 2030. There is strong demand both from domestic and international travellers.

- The hotel market, in terms of room count, has grown at a CAGR of 8.9% from FY 2012-22. The number of hotel rooms grew by 2X+ from 78 lakhs in 2012 to 1.7 crores in CY 2022. Average daily rate and occupancy are at decade highs.

- India provides low-cost (relative to developed economies) and high-quality medical treatment for foreigners. 7.3 million tourists are expected to visit India for medical treatments in 2024

- India is currently ranked number 9th in the world in terms of business travel spending.

- With changing consumer preferences and lifestyles, the restaurant business is growing. India’s overall food industry is expected to grow from Rs 4-5 Trillion in 2023 to Rs 9-10 Trillion in 2030

- We are seeing new travel trends like Staycations and Workcations since the COVID-19-related lockdowns. Staycations have surged 30%, while Workcations have surged 25% since lockdowns.

- The Government has increased the budgetary allocation for the Tourism sector by nearly 45%, from Rs 1,692 crores in FY 2022-23 to Rs 2,400 crores in FY 2023-24.

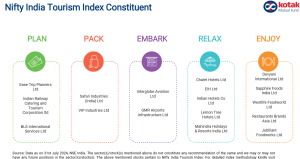

About Nifty India Tourism Index

The Nifty India Tourism Index aims to track the performance of stocks from the Nifty 500 Index, which represents the travel and tourism theme. The weight of each stock in the index is based on free-float market capitalization. Stock weights are capped at 20%. The index is reconstituted semi-annually and rebalanced quarterly.

Well crafted in chronological:

PLAN. PACK. EMBARK. RELAX. ENJOY

Source: Kotak MF

Drivers of tourism growth in India

Source: Kotak MF

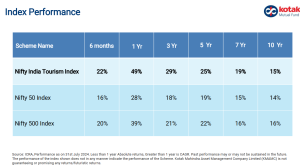

How has the Nifty India Tourism Index performed versus broad market indices?

Source: Kotak MF

About Kotak Nifty India Tourism Index Fund:

- Category: Other Index Fund

- Type of Scheme: An open-ended scheme replicating/tracking the Nifty Tourism Index

- Fund Manger: Mr. Devendra Singhal, Mr. Satish Dondapati and Mr. Abhishek Bisen

- Min subscription amount: Rs. 100/- and any other amount after that

- Investment Objective: The scheme is to provide returns that, before expenses, correspond to the total returns of the securities as represented by the underlying index, subject to tracking errors. However, there is no assurance that the investment objective of the scheme will be achieved.

- Benchmark: Nifty India Tourism Index (TRI)

Please refer to the scheme’s Scheme Information Document (SID) for complete details about the minimum application amount for ongoing purchases.

For detailed Asset allocation, please refer to Scheme Information Document (SID)

Why invest in Kotak Nifty India Tourism Index Fund?

- Travel Surge: Tourism is the new wave of consumer spending.

- Infrastructure Boom: Highways, airports, and routes are making travel more accessible.

- Broad Exposure: Invest in airlines, hotels, restaurants and more.

- Diverse Destinations: From pilgrimages to business hubs and adventure trails, India offers it all

- Low-Cost Fund: The TERs of index funds are much lower than TERs of actively managed equity mutual fund schemes

- Convenience of mutual funds: You do not need a demat account to invest in Kotak Nifty India Tourism Index Fund. You can invest in this fund through SIP. You redeem your units with the AMC instead of selling them on the stock exchange.

Who should invest in Kotak Nifty India Tourism Index Fund?

- Investors looking for capital appreciation over long investment tenures through passive investing.

- Investors who want to invest in the tourism theme

- Investors with very high-risk appetites

- It would be best if you had a minimum investment tenure of 3 to 5 years.

- Investors should consult with their financial advisors or mutual fund distributors to determine whether the Kotak Nifty India Tourism Index Fund is suitable for their investment needs.

Riskometer and Disclaimer:

Source: Kotak MF

![]()

Rahul Agrwal

Founder & CEO, Singhal Capital FinServe and Your Money Mantra

AMFI Registered Mutual Fund Distributor